BTC Price Predictions: What’s Next for ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, XLM, and SUI?

Bitcoin is at risk of losing the $115,000 support, raising the chance that the recently started altcoin season could abruptly end.

Bitcoin is at risk of losing the $115,000 support, raising the chance that the recently started altcoin season could abruptly end.

Data shows the market still favors ETH even after Bitcoin’s sharp sell-off to $115,000.

Ether’s recent surge in social media dominance signals the potential risk for a price correction, according to Santiment.

Japan’s slow and risk-averse approval system, not taxes, is the real barrier driving Web3 startups and liquidity offshore, says WeFi CEO Maksym Sakharov.

Wrench attacks on prominent crypto executives are shaping the narrative on centralized crypto custody.

XRP selling pressure could mushroom if the recent 50 billion XRP sale from a wallet linked to Ripple’s Chris Larsen was “just the warm-up.”

Analysts call XRP’s dip on Thursday a healthy correction, while Galaxy Digital’s CEO says Ether could outperform Bitcoin within the next six months, and other news.

XRP selling pressure could mushroom if the recent 50 billion XRP sale from a wallet linked to Ripple’s Chris Larsen was “just the warm-up.”

Analysts call XRP’s dip on Thursday a healthy correction, while Galaxy Digital’s CEO says Ether could outperform Bitcoin within the next six months, and other news.

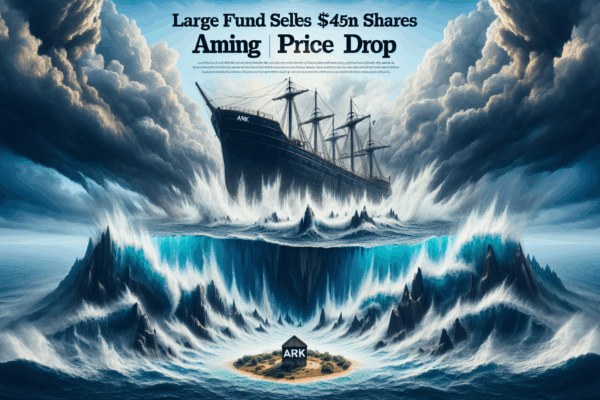

In the past two days, ARK has offloaded a total of 642,766 Circle shares, accounting for 14% of its 4.49 million CRCL purchase made during the company’s public launch.